In the context of the continuous growth of global healthcare demands, accelerated population aging, and the wave of technological innovation, the medical injection molding industry is undergoing a profound transformation from traditional manufacturing to high-end intelligent equipment. Over the next five years, the Chinese medical injection molding market will exhibit three core trends: accelerated technological iteration, deepened industrial chain collaboration, and expanded global layout. These development paths not only contain breakthrough opportunities but also face structural challenges.

I. Technological Breakthroughs: Leap from Precision Manufacturing to Intelligent Ecosystems

1. Materials Science Leads Functional Upgrades

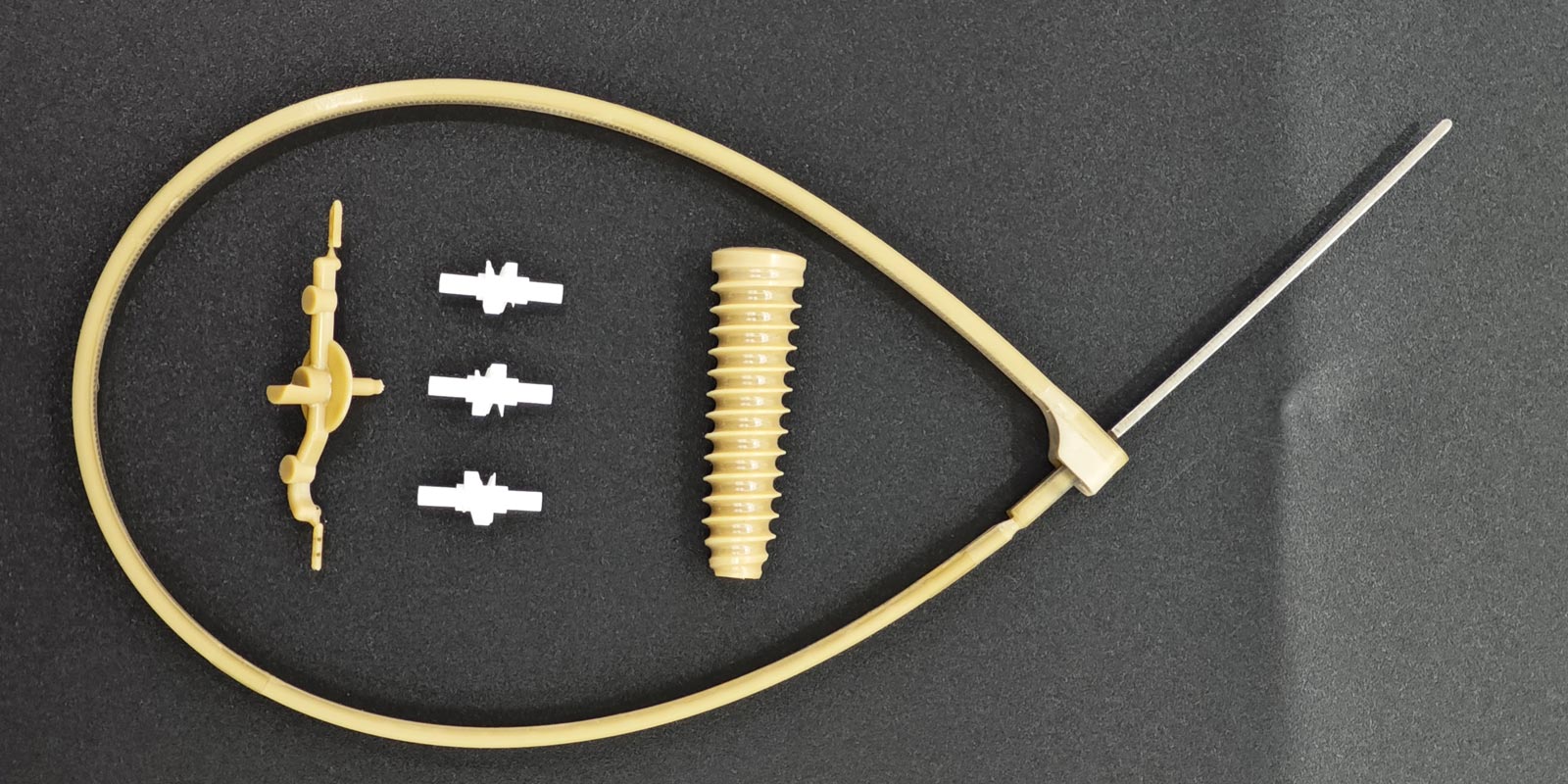

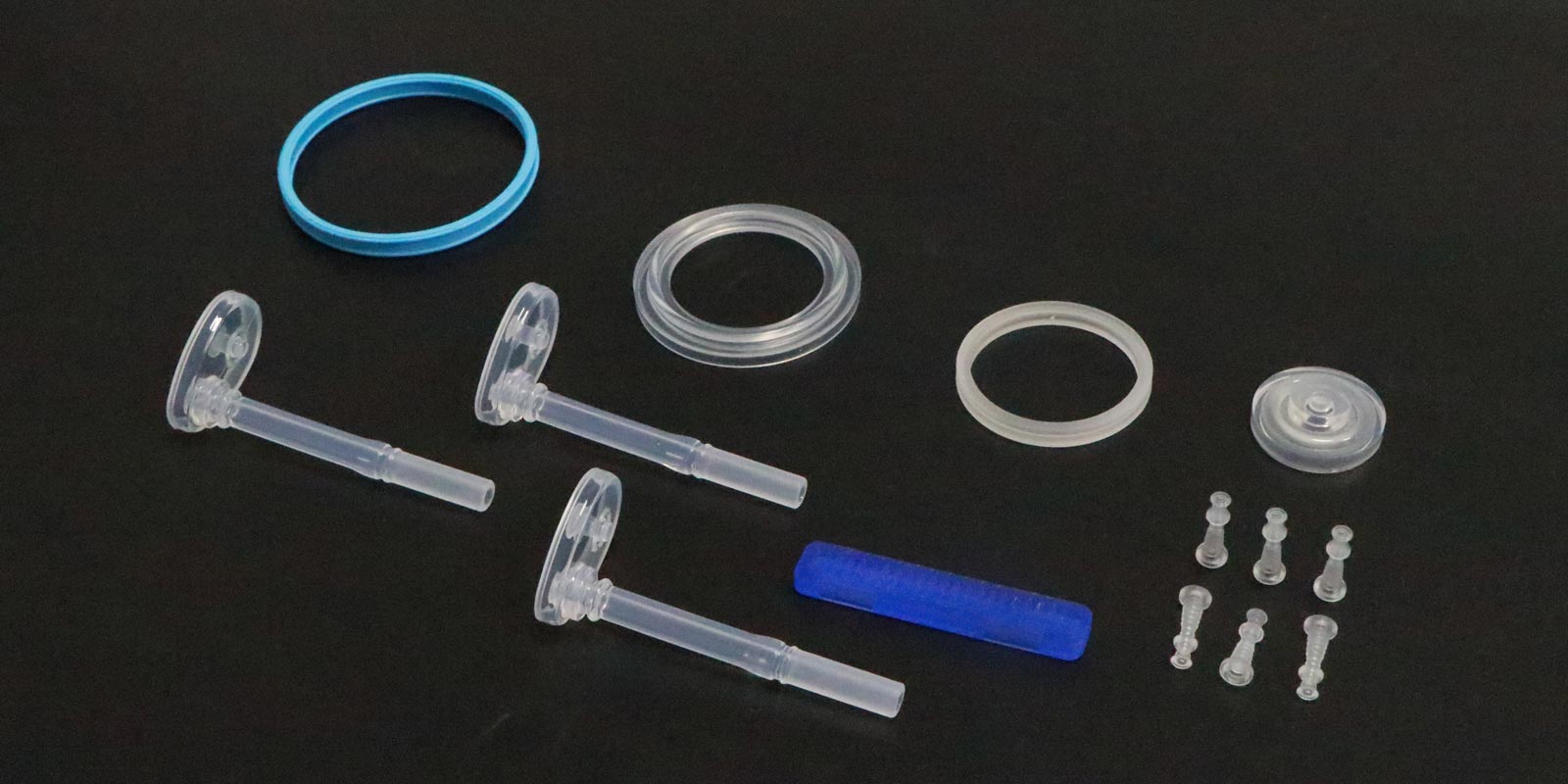

The penetration rate of biodegradable materials (such as polylactic acid (PLA) and polycaprolactone (PCL)) is expected to rise from less than 10% in 2024 to 35% in 2030, driving the transformation of disposable consumables towards environmental friendliness. For example, Tuoren International has resolved the international challenge of low clearance rates for specific toxins through integrated resin synthesis technology for perfusion devices, with its antibacterial coating technology reducing the infection rate of medical devices by 40%. Meanwhile, the research and development of special materials such as antibacterial silicone and high-temperature-resistant polyether ether ketone (PEEK) will meet the stringent requirements of materials performance for minimally invasive surgical instruments and implantable devices.

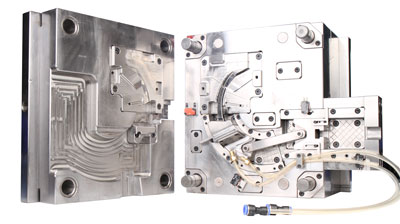

2. Injection Molding Process Evolves towards Micro-nano Precision

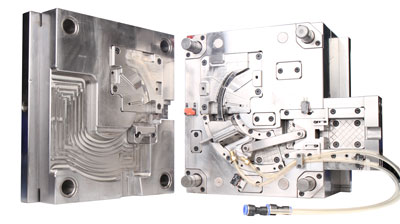

All-electric injection molding machines have become the mainstream equipment for high-end medical products due to their repeatability accuracy of ±0.005 mm. In 2024, the application of multi-cavity mold technology in the production of artificial joint components increased efficiency by 1.8 times, while 3D printing-assisted mold design improved the first-pass yield of complex structural parts to 92%. Husky Medical's UltraSync™ synchronous push-plate system achieves cavity-to-cavity dimensional consistency over one million production cycles by precisely controlling valve pin movements, meeting the tolerance requirements (≤ ±0.01 mm) for heart stents and other implants.

3. Intelligent Manufacturing Reconstructs Production Paradigms

Industry 4.0 technologies are deeply penetrating the sector, with the procurement ratio of intelligent injection molding units expected to reach 46% in 2025, up 7 percentage points from 2024. Leaxing Machinery's CSI4.0 intelligent factory solution optimizes process parameters through AI algorithms, increasing the Overall Equipment Effectiveness (OEE) by 25% and reducing energy consumption by 18%. Dongcheng Precision's smart factory achieves full-process digital control from raw material drying to packaging and warehousing, with a pass rate exceeding 99.3%, driving a 3-5 percentage point increase in industry profit margins.

II. Industrial Collaboration: Reconstruction from Single Equipment to Ecosystems

1. Vertical Integration of the Industrial Chain Accelerates

Leading enterprises are strengthening full-chain control through mergers and acquisitions and strategic partnerships. After acquiring a precision injection molding factory, Bokom Medical shortened the delivery cycle of high-end stent products by 50% and achieved a price premium of 25%. Weigao Group integrated mold supplier resources to provide "injection molding + assembly" one-stop services to 3,000 tertiary hospitals, with business volume growing by 42% in 2024. This bundled model of "equipment + molds + materials" is reshaping the competitive landscape of the industry.

2. Regional Cluster Effects Become Prominent

The Yangtze River Delta region accounts for 65% of the national medical injection molding production capacity, relying on medical device clusters in Suzhou and Changzhou for minimally invasive devices. The Pearl River Delta region has formed an 8 billion-yuan industrial park leveraging Guangzhou and Dongguan's advantages in in vitro diagnostic equipment injection molding. The central and western regions are capturing 27% of the market share in basic consumables such as syringes and infusion sets through industrial transfer. In 2025, the number of newly built medical injection molding production lines in the central and western regions is expected to increase by 26% year-on-year, indicating a trend of balanced regional development.

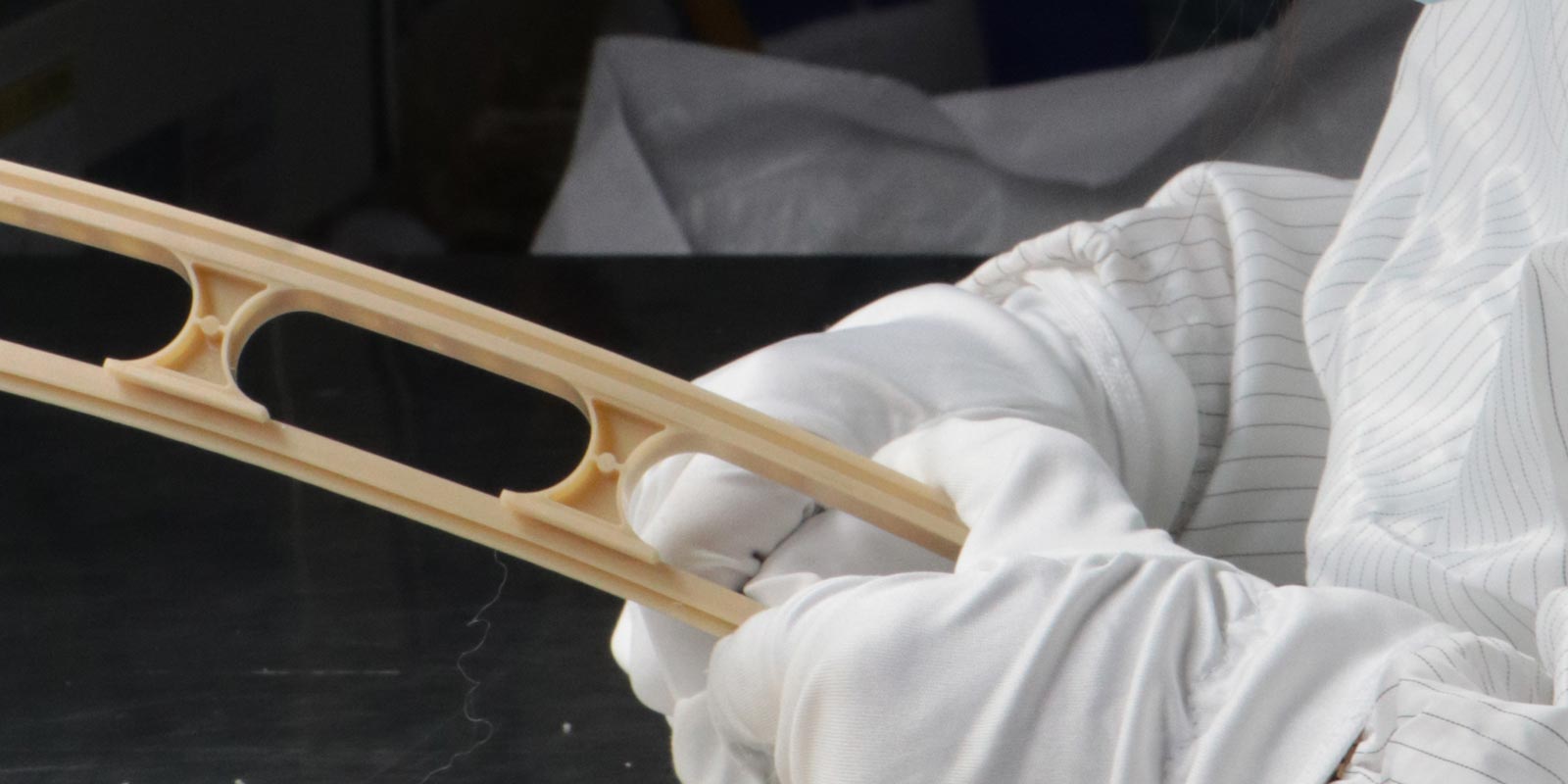

3. Compliance Drives Standard Upgrades

The strengthening of the Good Manufacturing Practice (GMP) regulations for medical device production by the National Medical Products Administration is prompting enterprises to upgrade their sterile environment control systems. In 2024, the procurement ratio of high-end injection molding units equipped with robotic arm linkage systems and cleanroom-adapted modules reached 38.6%, up 5.2 percentage points from 2023. Meanwhile, the new EU Medical Device Regulation (MDR) has increased the average compliance cost for domestic enterprises by 35%, forcing the industry to align with international standards.

III. Global Layout: From Domestic Substitution to International Competition and Cooperation

1. Southeast Asian Markets Become New Growth Poles

With the implementation of "medical new infrastructure" policies in Southeast Asia, China's export volume of injection molding equipment increased by 12% year-on-year in 2024, with orders from Malaysia and Vietnam accounting for over 40%. Haitian International and Yizumi Precision Machinery have strengthened customer loyalty by establishing technical service centers locally, shortening equipment delivery cycles to 30 days.

2. Breakthroughs in High-end Markets Overcome Technological Barriers

Domestic brands have achieved partial superiority in all-electric injection molding machines: Haitian Plastics Machinery leads the global market with a 28% share and excels in precision control. Leaxing Machinery's WIZ-E Plus electric injection molding machine has entered the supply chains of leading enterprises such as Mindray Medical and Yuyue Medical through its custom PRESS UNIT design for the medical industry. In 2024, the penetration rate of domestic equipment in production lines for consumables配套 (supporting) tertiary hospitals reached 29%, up 14 percentage points from 2020.

3. Innovative Service Models Expand Value Boundaries

The Contract Manufacturing Organization (CMO) model is rapidly emerging, with the market size of medical injection molding outsourcing services growing by 6.2% year-on-year in 2024. SNIBE reduced the overall cost of its automated immunoassay analyzers by 18% and improved delivery efficiency by 25% by outsourcing the production of instrument housings to domestic injection molding enterprises. This asset-light operation model is attracting more medical device manufacturers to divest non-core manufacturing segments.

IV. Challenges and Responses: Finding Balance Points amid Transformations

1. Supply Chain Security Risks

High-end mold steel still relies on imports, and the prices of special engineering plastics rose by 15% in 2024 due to fluctuations in international crude oil prices. Enterprises need to build resilient supply chains through diversified supplier strategies and localized raw material research and development (e.g., Kingfa Scientific's localization rate of medical-grade polypropylene exceeding 78%).

2. Pressure to Catch Up Technologically

Japanese brands still hold advantages in intelligent modular design. Fanuc's AI process self-optimization system can increase the pass rate to 99.5%, while the average level of domestic equipment is 98.7%. Enterprises need to increase R&D investment, with the industry's R&D intensity reaching 5.1% in 2024, up 1.3 percentage points from 2021.

3. Talent Shortages Constrain Development

The medical injection molding sector requires both R&D talent proficient in polymer material science and compliance experts well-versed in GMP regulations. According to statistics, the industry will face a talent gap of 120,000 compound talents by 2025. Enterprises need to improve talent pipelines through university-enterprise collaborations (e.g., Shanghai Jiao Tong University's joint training of 3D printing technology talents with the Ninth People's Hospital's Department of Orthopedics) and internal training systems.

Conclusion: Sailing towards a New Blue Ocean of High-Quality Development

Over the next five years, the Chinese medical injection molding industry will achieve a leap from scale expansion to value creation, driven by technological innovation and industrial upgrading. It is expected that the market size will exceed 80 billion yuan by 2030, with a compound annual growth rate maintained at 8%-10%. Enterprises need to use technological innovation as a spear and compliant operations as a shield to build differentiated advantages in global competition, jointly promoting the industry towards "precision, intelligence, and greenness" and providing Chinese solutions for global healthcare.

Home

Home