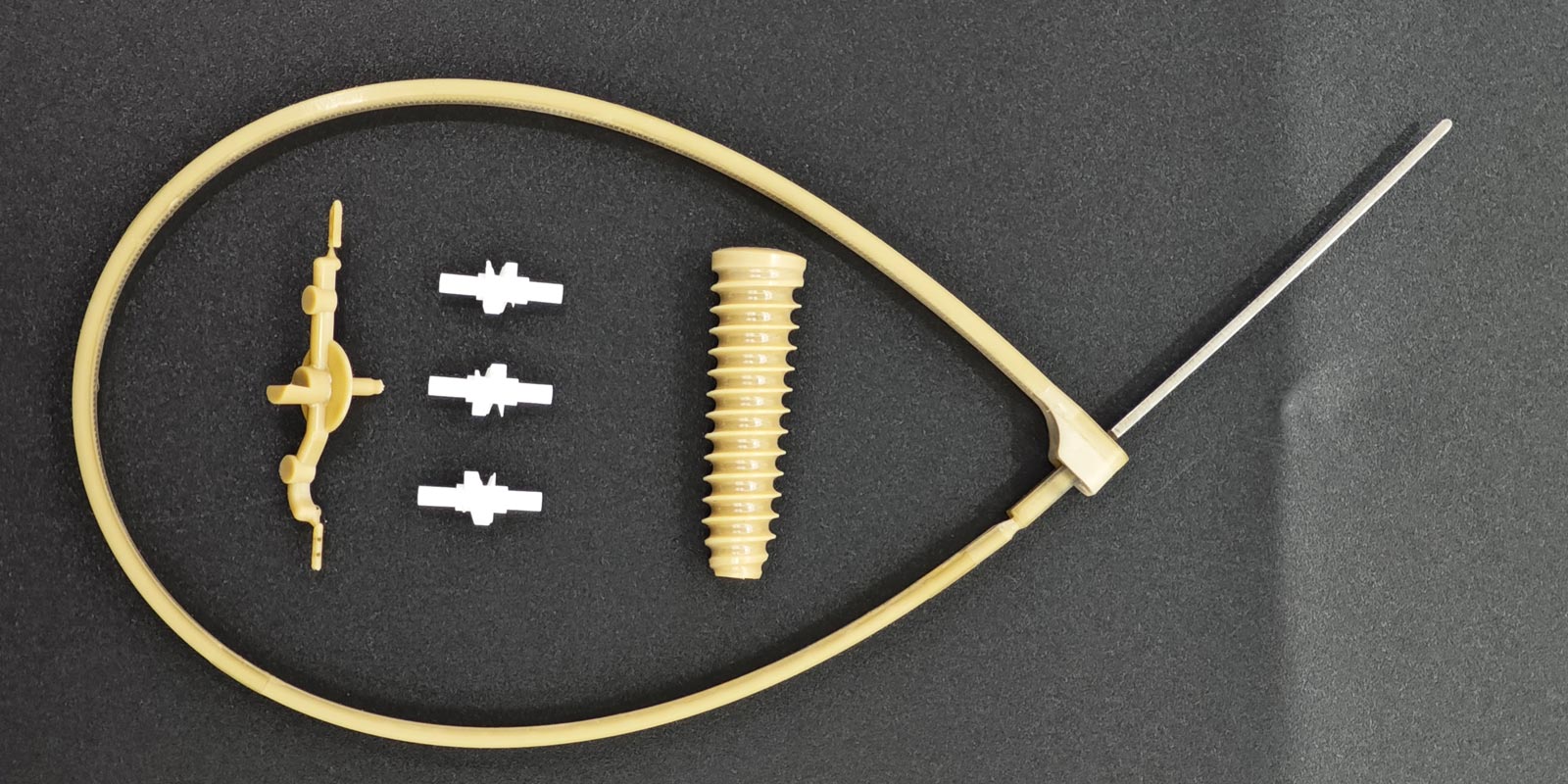

In the medical field, a mold for a cardiac stent may be worth hundreds of thousands of yuan, and a set of tumor radiotherapy positioning molds can easily cost several thousand yuan. Behind these seemingly "exorbitant" figures lies the ultimate protection of human dignity in the medical mold industry. As the core tool for manufacturing medical devices, the price composition of medical molds is far more complex than that of ordinary industrial molds. Their high cost is essentially a combination of technical barriers, material costs, process complexity, and the value of life.

I. Material Costs: The "Gold Standard" of Medical-Grade Materials

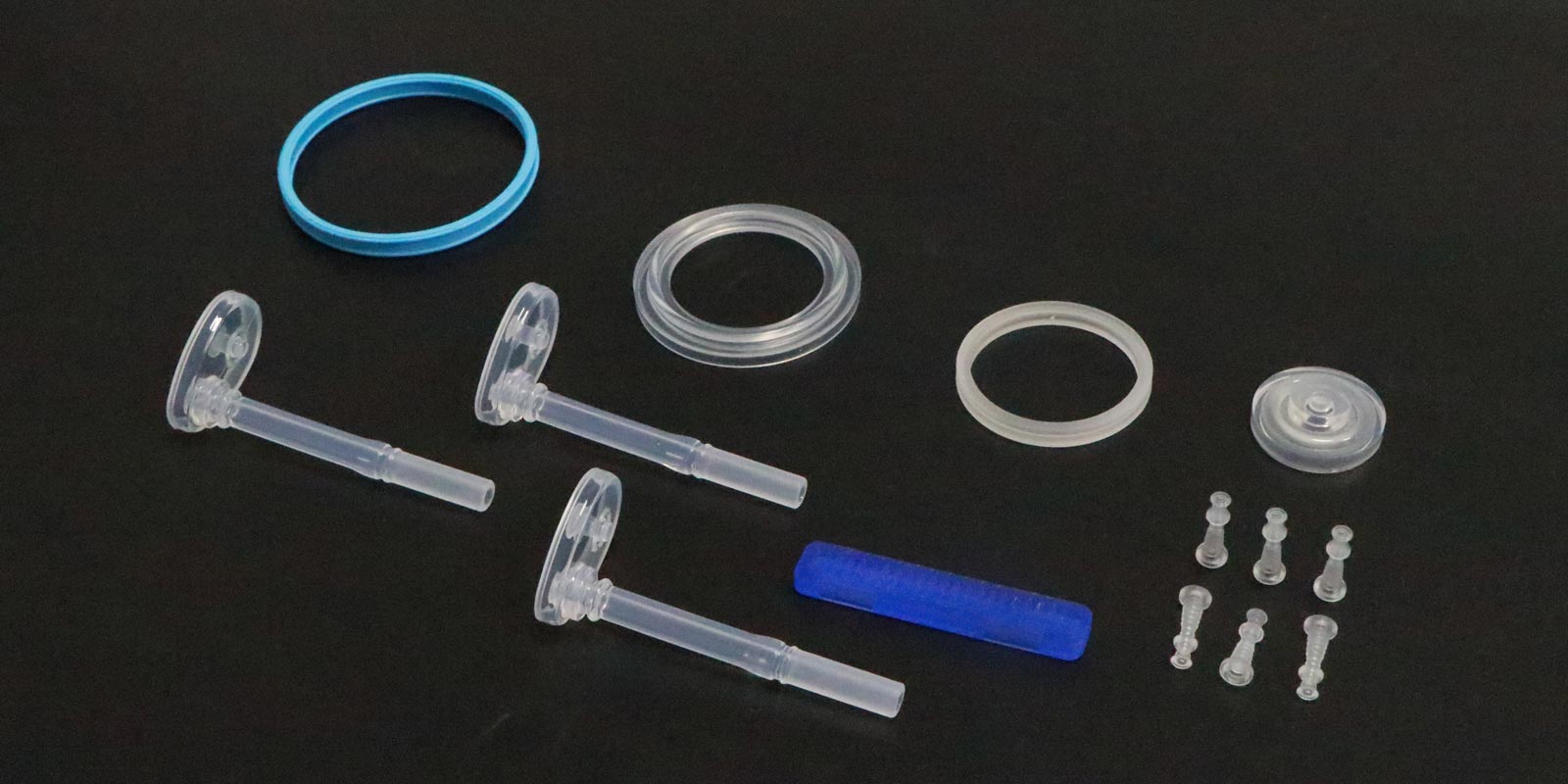

Medical molds have extremely stringent requirements for the biocompatibility, corrosion resistance, and fatigue resistance of materials. Take radiotherapy positioning molds as an example. Their main bodies need to be made of medical-grade polyurethane or silicone. These materials must pass the ISO 10993 biocompatibility certification to ensure that they do not cause allergies or toxicity when in long-term contact with human tissues. A radiotherapy mold for intracranial tumors purchased by a top-tier hospital uses silicone raw materials that cost 800 yuan per kilogram, five times more expensive than ordinary industrial silicone.

Even more extreme are the molds for cardiac stents. Their core components require cobalt-chromium alloy or nickel-titanium alloy, which combine superelasticity and thromboresistance. However, only a few companies worldwide can produce raw materials that meet medical standards. In 2024, a domestic supplier of cardiac stent molds disclosed that raw material costs account for 45% of the total mold price, while imported cobalt-chromium alloy can reach 2 million yuan per ton, truly earning the title of "gold among metals."

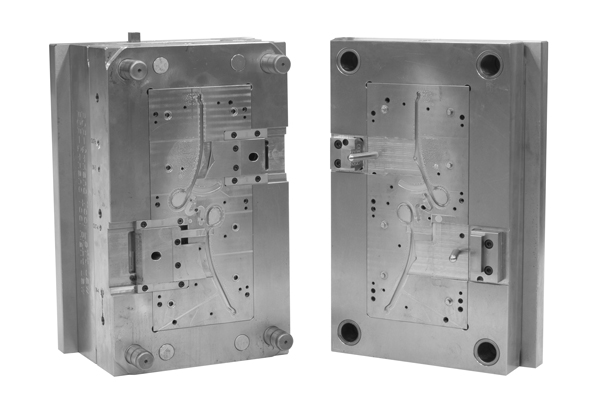

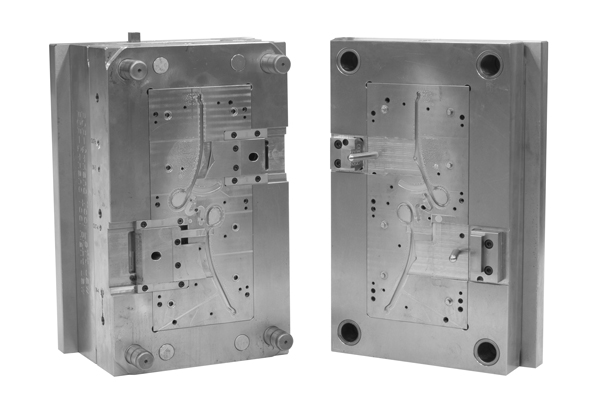

II. Process Complexity: A Life-Saving Project with Micron-Level Precision

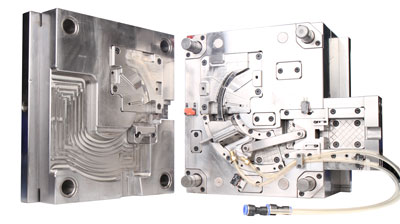

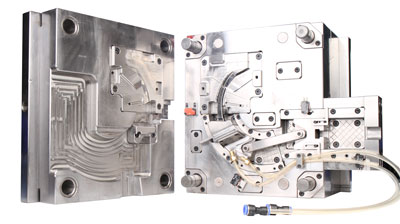

The manufacturing precision of medical molds is often measured in micrometers (μm). For example, the mold for the optical lens of an ophthalmic surgical microscope requires a surface roughness of less than Ra0.01μm, equivalent to flattening the Earth's surface to the size of a glass bead. To achieve this standard, manufacturers need to use five-axis联动 (simultaneous five-axis) ultra-precision machining centers, with each machine costing over 8 million yuan. Moreover, nanoscale tool compensation is required every 100 hours of operation.

In the field of tumor radiotherapy, the manufacturing of molds for complex cases represents the pinnacle of "3D printing + artificial intelligence." A medical technology company customized a radiotherapy mold for a patient with a brainstem tumor. First, it obtained image data with a layer thickness of 0.5 mm through MRI scans. Then, it used deep learning algorithms to construct a three-dimensional tumor model. Finally, it employed simultaneous multi-axis 3D printing technology to control errors within 0.1 mm. The entire process involves 12 professional fields, including medical image processing, biomechanical simulation, and additive manufacturing, with a research and development cycle of three months and labor costs accounting for over 30% of the total price.

III. Technical Barriers: A Lifeline Subject to "Chokepoint" Restrictions

There are significant technical gaps in the medical mold industry. Take heart valve molds as an example. Their core patents are monopolized by multinational companies such as Edwards Lifesciences in the United States and Corin Group in Germany. Domestic companies wishing to produce similar products must pay a patent licensing fee of 15% of the selling price of each mold. In 2023, a domestic heart valve company disclosed that patent fees account for 28% of its mold procurement costs, directly driving up the price of end products.

Even more severe is the dependence on high-end equipment. Over 90% of the key equipment used by domestic medical mold manufacturers, such as five-axis联动 (simultaneous five-axis) machining centers and electron beam melting (EBM) 3D printers, is imported. A mold company purchased an ultra-precision machine tool from DMG MORI in Germany for over 12 million yuan, with annual maintenance costs of 2 million yuan. This equipment monopoly makes it difficult for domestic companies to reduce costs through large-scale production, creating a vicious cycle of "high prices and low volumes."

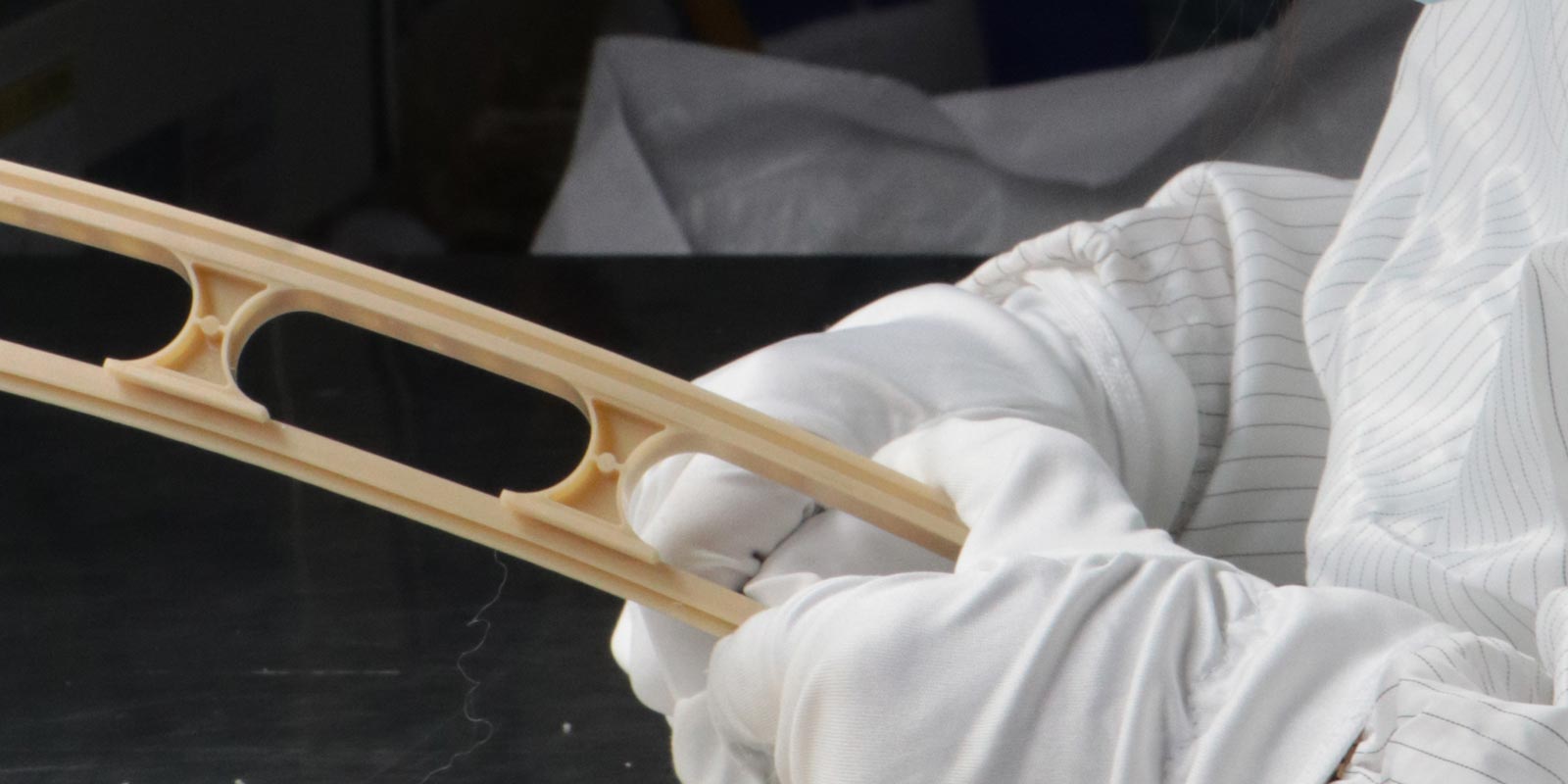

IV. Value of Life: Precision Beyond Monetary Measurement

The high cost of medical molds is essentially an ultimate pursuit of life quality. Take pediatric radiotherapy molds as an example. Due to the immature skeletal development of children, traditional adult molds can cause a 5%-8% dose deviation, potentially leading to secondary primary tumors. A children's hospital adopted customized radiotherapy molds that obtain skeletal growth data of pediatric patients through CT scans and use finite element analysis to predict body shape changes over the next three years, ultimately manufacturing modular molds that can be dynamically adjusted. The research and development cost of such "growth-adaptive" molds is five times that of ordinary molds, but they can reduce the incidence of radiotherapy side effects from 12% to 2.3%, safeguarding hope for countless families.

In the field of orthopedic implants, the value of personalized knee molds is even more precious. A 78-year-old patient required joint replacement due to severe osteoarthritis, but traditional standard-sized molds could not match his unique bone morphology. After customizing a mold through 3D scanning, the surgical time was shortened from 3 hours to 1.5 hours, and the postoperative rehabilitation period was reduced by 40%. Although the mold cost 8,000 yuan more than the standard model, the patient avoided the risk of secondary surgery, and the saved medical expenses and improved quality of life far exceeded the cost difference.

V. The Path Forward: Localization and Technological Innovation

Faced with the dilemma of high prices, China's medical mold industry is breaking through. In 2024, a company in Shanghai achieved a breakthrough in self-developed metal 3D printing equipment, reducing the printing cost of cardiac stent molds from 12,000 yuan per set to 4,500 yuan and tripling the printing efficiency. In the field of materials, a company in Jiangsu developed medical-grade polyether ether ketone (PEEK) material, which reaches 95% of the performance of imported products but is 40% cheaper, and has been applied in the manufacturing of spinal fusion device molds.

At the policy level, new regulations from the National Medical Products Administration in 2025 require Class III medical device molds to pass "full lifecycle traceability" certification, driving the industry to shift from "price competition" to "value competition." A procurement officer from a top-tier hospital said, "Now we focus more on the clinical data support and long-term stability of molds rather than simply pursuing low prices." This trend is prompting companies to increase R&D investment, forming a positive cycle of "technological upgrading - cost reduction - market expansion."

The high cost of medical molds is the result of a battle between the dignity of life and technological limits. When a mold for a cardiac stent carries the precision of tens of thousands of heartbeats and when a radiotherapy mold safeguards the survival hopes of tumor patients, these "exorbitant" figures represent humanity's eternal pursuit of life quality. With localization breakthroughs and technological iterations, medical molds will eventually break free from the "high-price dilemma," but the relentless pursuit of precision and reverence for life will forever be engraved in the DNA of the medical industry.

Home

Home